Calculate salary per hour after tax

4391396 net salary is 5600000 gross salary. This marginal tax rate means that your immediate additional income will be taxed at this rate.

4 Ways To Calculate Annual Salary Wikihow

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level.

. Loan payments 3000 and equipment 2500. Finally dividing by 12 yields a. A small difference here is the income tax public provident fund and professional tax are taken as percentage of gross salary in the input.

After spending about hour working out what my txt rate would be with my student loan etc I. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis. In the case of any calendar year after 2014 the applicable per-employee dollar amounts of 2000 and 3000 are increased based on the premium adjustment percentage as defined in section 1302c4 of the Affordable Care Act for the year rounded to.

3203075 net salary is 4000000 gross salary. To turn that back into an hourly wage the assumption is working 2080 hours. Just enter your gross annual salary into the box and click Calculate - then well present you with an overview of your tax and net salary.

Legal or tax advice. 56000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. If you earn 15 per hour and work 40 hours per week your weekly gross salary is 600.

In addition such information should not be relied upon as the only source of information. However the calculator will display net salary after income tax deduction. 2988200 net salary is 3500000 gross salary.

For example if you make 20 per hour and work 40 hours per week your annual salary equals 41600 40 hours per week x 52 weeks in a year x hourly wage. Each and every single cent could be tracked. State Taxes of 4.

This means that the hourly rate for the average UK salary is 1504 per hour. 80k Per Year After Taxes is 61080. New York City also set a pay floor of 1722 an hour after expenses for ride-hail drivers.

Continue reading to find out more about the minimum wage for Australia. Aside from the high earning city slickers there are plenty of Australians who get by on the national minimum wage of 2033 per hour. For example if youre paid 15 per hour and work 40 hours per week your weekly gross pay is 600.

40000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Your average tax rate is 300 and your marginal tax rate is 357This marginal tax rate means that your immediate additional income will be taxed at this rate. After filling out the order form you fill in the sign up details.

Multiplying this amount by 52 shows an annual gross income of 31200. Multiply your hourly wage by the number of work hours per day. I was trying to find out my net pay after tax for 7000000.

35000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. If you add your annual salary to your annual fringe benefit value you can see you are compensated annually in the amount of 50160 41600 8560. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

After this youll have a good idea of your fixed costs so youll only need to track your variable costs in the future. For claim periods starting on or after 1 May 2021 when you calculate the average wages for employees on variable pay you should not include days during or wages related to a period of family. Federal Taxes of 12.

Ensure you request for assistant if you cant find the section. So how much an hour is 80000 a year after taxes. This would be your net annual salary after taxes.

If you make 300000 kr a year living in the region of Aabenraa Denmark you will be taxed 103464 krThat means that your net pay will be 196536 kr per year or 16378 kr per month. What is a 56k after tax. Calculate your fixed costs.

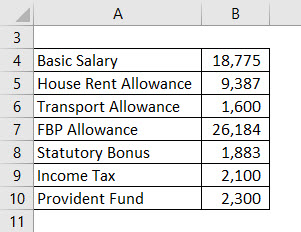

Net Salary Gross Salary Income Tax Public Provident Fund Professional Tax. What is a 40k after tax. Your average tax rate is 314 and your marginal tax rate is 384.

The Bureau of Labor Statistics BLS publishes a range of indicators that point to the extent to which labor resources are being utilized. Finally dividing by 12. In 2019 Venessa Wong from BuzzFeed reported that drivers in NYC were earning more than 16 per hour.

So first the amount is calculated using. In our example your daily salary would be 136 17 per hour times 8 hours per. How to Calculate Annual Salary.

60163 per week 366 hours per week 1504 per hour. For instance an increase of 100 in your salary will be taxed 3843 hence your net pay will only increase by 6157. Try actively tracking your expenses for one full month.

Susannes yearly salary equals 31200. Work hours per week 1 to 80 Work weeks per year 1 to 52. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year.

Known as U1 U2 and U4 through U6 U3 is the official unemployment rate these alternative measures of labor underutilization provide insight into a broad range of problems workers encounter in todays labor market. This equates to a weekly salary of 77260 for a 38-hour work week. If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month.

This pay was calculated after a cap was added on the number of rideshare vehicles allowed on the roads based on demand. What is a 35k after tax. 15 40 52 31200.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. AmountPercentageGrossSalary100 and then the below formula is used.

If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602That means that your net pay will be 36398 per year or 3033 per month. This article is based on Calculation Salary. Multiplying this figure by 52 yields a gross annual income of 31200.

If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate. To determine her annual income multiply all the values.

In addition we pay 7000 per month for workers that dont directly affect the. Your average tax rate is 345 and your marginal tax rate is 407This marginal tax rate means that your immediate additional income will be taxed at this rate. According to data from Statista the average salary in the UK is 31285Assuming they work 40 hours per week their hourly rate would be as follows.

Salary Formula Calculate Salary Calculator Excel Template

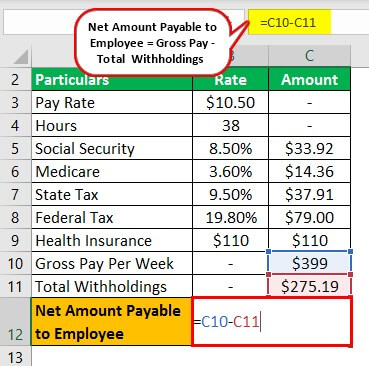

Payroll Formula Step By Step Calculation With Examples

17 An Hour Is How Much A Year Can I Live On It Money Bliss

Salary Formula Calculate Salary Calculator Excel Template

Hourly To Salary Calculator

4 Ways To Calculate Annual Salary Wikihow

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary What Is My Annual Income

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Net Pay Step By Step Example